Receiverships Pursuant to the Illinois Receivership Act

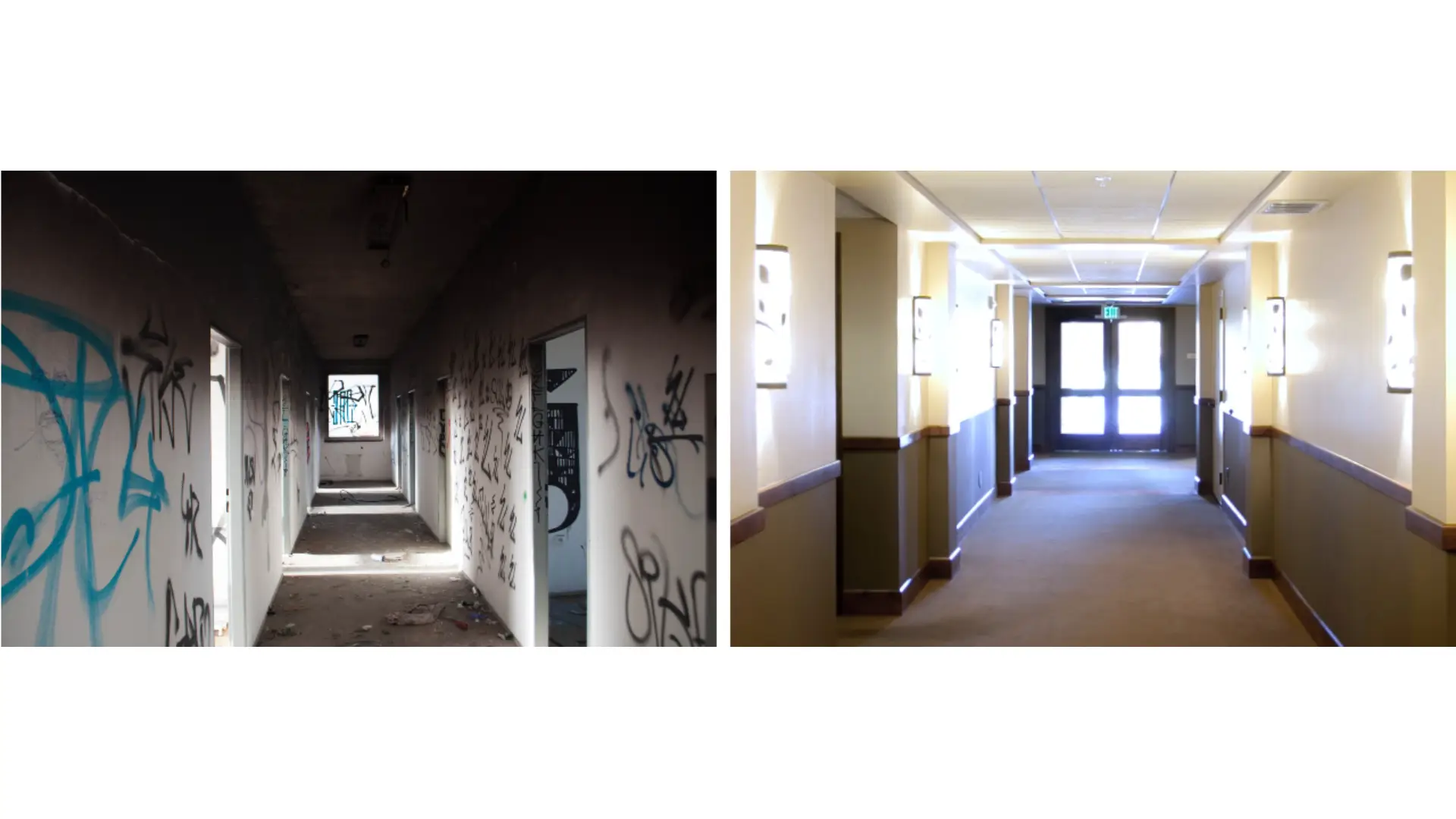

The Illinois Receivership Act, Public Act 104‑0034, effective January 1, 2026. As an experienced court-appointed receiver under the new Illinois Receivership Act, I provide professional, efficient, and transparent management of assets in real estate, business, and financial disputes. The Act empowers receivers to preserve property, oversee operations, and protect the interests of creditors and stakeholders, while adhering to strict fiduciary and reporting requirements. Leveraging this framework, I deliver reliable, court-supervised solutions that safeguard value, minimize risk, and ensure smooth resolution of complex cases providing judges, attorneys, and parties with confidence in every receivership engagement.

Under the Illinois Receivership Act, I leverage the court’s authority to provide structured, efficient, and legally compliant management of complex assets. This includes taking control of property or businesses, stabilizing operations, and implementing strategies to preserve and enhance value for all stakeholders. Through detailed reporting, transparent financial oversight, and consistent communication with the court and interested parties, I ensure that every receivership proceeds smoothly, efficiently, and in full compliance with statutory requirements, giving judges, attorneys, and creditors confidence in the process and outcomes.

Rich experience

Provides complex solutions

Reasonable fees

Modern technology

Brilliant team

24/7 online support

The effectiveness of my work is best reflected in the confidence of those I’ve served. Attorneys, lenders, and property owners consistently commend my responsiveness, integrity, and results-oriented approach. Their feedback underscores my commitment to transparency, professionalism, and achieving fair, efficient outcomes in every receivership engagement.

Testimonials

Frequently Asked Questions

What is a receiver?

A receiver is a neutral third party appointed by a court to take control of property, business operations, or assets that are the subject of litigation. The receiver’s role is to preserve, manage, and, when appropriate, liquidate those assets under the court’s supervision.

When is a receiver appointed?

A receiver is typically appointed when there is risk that assets will be wasted, mismanaged, or lost during litigation. Common examples include disputes over commercial real estate, operating businesses, or post-judgment collections.

How is a receiver appointed?

Receivers are often appointed on motions by a secured creditor, lender, investor, or other party with an interest in the property or business. The court ultimately decides whether a receivership is warranted.

What courts appoint you as receiver?

I serve as a court-appointed receiver in both Illinois State Courts and the U.S. District Court for the Northern District of Illinois, handling a wide range of real estate and business receivership matters.

For whom does the receiver work?

A receiver is an Officer of the Court and works as an agent of the court that appointed the receiver.

What's the geographical area the Illinois Receiver covers?

The Illinois Receiver primarily serves: Cook County, IL; Lake County, IL; DuPage County, IL; Kendall County, IL; McHenry County, IL, Will County, IL; and, Kane County, IL.

How quickly can Illinois Receiver take control of a property?

The Illinois Receiver has the ability to obtain a bond, bring together people and resources needed within 24 hours of a court ordered receivership to assume control and management of any asset.

How long does a receivership typically last?

The duration depends on the complexity of the matter. Some receiverships conclude in a few months, while others may continue for a year or more until the court determines that the matter has been resolved.

What types of assets or entities do you manage?

I manage commercial and residential real estate, operating companies, investment properties, condominium associations, and other assets involved in financial disputes or foreclosure actions.

What is your role once appointed as receiver?

Once appointed, I take control of the property or business, stabilize operations, account for all income and expenses, and report regularly to the court. My primary goal is to protect and preserve value for all interested parties.

How do you ensure transparency during a receivership?

All financial activity is recorded using modern accounting systems, with detailed reports submitted to the court and counsel. I maintain open communication with all stakeholders throughout the process.

Are receiverships expensive?

Receiverships are designed to protect value, not waste it. My fees are reasonable, transparent, and approved by the court. They are proportionate to the complexity and size of the engagement.

How are your fees paid?

Receivership fees and expenses are typically paid from the assets or income generated by the receivership estate, subject to court approval. My receiver’s fees are billed in 1/10 of an hour increments.

Can you act as receiver in other states?

My primary jurisdiction is Illinois, where I have extensive experience in both state and federal courts. For out-of-state matters, I can collaborate with local counsel or professionals as permitted by the court.

What qualifications or experience do you have?

I have decades of experience in receivership administration, asset management, and court-supervised liquidations. I’ve served in numerous complex cases involving real estate, business operations, and post-judgment enforcement.

How does a receiver differ from a bankruptcy trustee?

While both are fiduciaries, a receiver is appointed by a state or federal court outside of bankruptcy, whereas a trustee operates under the U.S. Bankruptcy Code. Receiverships often move faster and focus on asset preservation before or instead of bankruptcy.

What happens to employees during a business receivership?

Each case is unique. In some cases, employees continue working under the receiver’s supervision; in others, operations may be suspended. My goal is to maintain value and minimize disruption whenever possible.

Can you sell property under a receivership?

Yes. With court approval, I can market and sell receivership property. Sales are conducted transparently and reported to the court for confirmation.

How are creditors involved in the receivership process?

Creditors are kept informed through court filings and reports. They may also submit claims, participate in hearings, and receive distributions if assets are liquidated.

What technology do you use to manage cases?

I use secure, cloud-based financial and property management platforms that allow for real-time tracking, digital reporting, and 24/7 access for authorized parties.

Can parties contact you directly about a receivership?

Yes. Attorneys, lenders, and court officers are encouraged to contact me directly with questions or concerns. I maintain open, professional communication at all stages of the engagement.

What should a lender or attorney include when requesting a receiver appointment?

Typically, a motion or petition includes the legal basis for appointment, a proposed order, receiver’s resume, and a description of the property or business. I can assist counsel in drafting or reviewing proposed receivership orders when appropriate.

How can someone learn more or request your services?

You can contact me directly through the contact page of this website, by phone at 312-607-4646, or by email at vandervant@illinoisreceiver.com. I’m available to discuss potential receivership matters, provide insight, or assist with drafting language for court filings.